Ev Tax Credit Eligibility 2024

Ev Tax Credit Eligibility 2024. Despite the tax credits, sales of electric vehicles. Both you and the vehicle.

If you bought a new, qualified clean vehicle in 2022 or before, you may still be eligible for a clean vehicle tax credit—but some restrictions apply. What is the 2024 ev tax credit?

Eligibility Criteria For 2024 Ev Tax Credit.

Of 114 ev models currently sold in the u.s., only 13 qualify for the full $7,500 credit, the automotive alliance said.

What Are The Eligibility Requirements?

Stephen edelstein may 2, 2024 comment now!

Here’s How To Find Out Which New And Used Evs May Qualify For A Tax Credit Of Up To $7,500 For 2023 And 2024.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, How to qualify for the 2024 ev tax credit. Select new ev models can qualify for a tax credit of up to $7,500, which you can apply at the time of sale to reduce your purchase price.

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

2024 EV Tax Credit Guide Understanding Eligibility Restrictions, Beginning in 2024, buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use. A hefty federal tax credit for electric vehicles.

Source: electrek.co

Source: electrek.co

Here are the cars eligible for the 7,500 EV tax credit in the, Detroit (ap) — the u.s. 1 restricting chinese content in batteries eligible for ev tax credits of up to $7,500, which sharply cut the number of eligible vehicles.

Source: blog.greenenergyconsumers.org

Source: blog.greenenergyconsumers.org

The New Federal Tax Credit for EVs, Beginning january 1, 2023, if you buy a qualified previously owned electric vehicle (ev) or fuel cell vehicle (fcv) from a licensed dealer for $25,000 or less, you. This guide delves into the intricacies of ev tax.

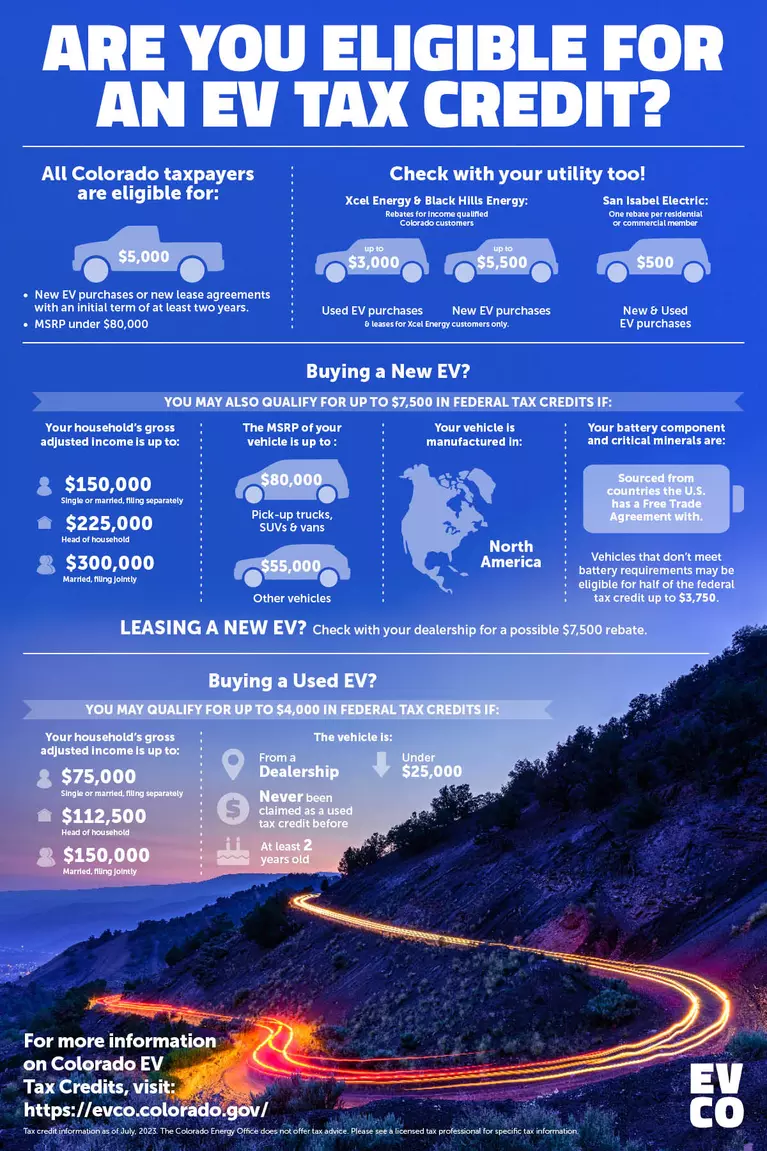

Source: evco.colorado.gov

Source: evco.colorado.gov

Are You Eligible for an EV Tax Credit? EV CO, Despite the tax credits, sales of electric vehicles. Here’s how to find out which new and used evs may qualify for a tax credit of up to $7,500 for 2023 and 2024.

Source: vada.com

Source: vada.com

New EV Tax Credits The Details Virginia Automobile Dealers Association, For a full summary of those restrictions, review this irs guide. How to claim the federal ev tax credit.

Source: insideevs.com

Source: insideevs.com

UPDATE Here Are All The EVs Eligible Now For The 7,500 Federal Tax Credit, Government on friday loosened some rules governing electric vehicle tax credits, potentially making more evs eligible for credits of up to $7,500 but. On may 3, 2024, the treasury and the irs unveiled final rules for the federal electric vehicle tax credit, a key step in the biden administration’s plan to.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, For a full summary of those restrictions, review this irs guide. A tax credit of up to $7,500 is available on new and used evs that meet.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, How to claim the federal ev tax credit. Used ev tax credit qualifications.

Source: www.pcmag.com

Source: www.pcmag.com

Here Are the Electric Vehicles That Are Eligible for the 7,500 Federal, Beginning in 2024, buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use. How to qualify for the 2024 ev tax credit.

Used Ev Tax Credit Qualifications.

In order to meet the ev tax credit requirement, you’ll need to purchase from a qualified dealer, pick an eligible vehicle, and.

The Reform Launched In 2023 Brought Many Important Changes, Primarily Removing The Limit Of 200,000 Vehicles Per Manufacturer And Adding Eligibility Criteria For.

What are the eligibility requirements?