2024 Personal Property Tax

2024 Personal Property Tax. Iras will send customised sms reminders with your property address, tax amount to be paid and. Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal.

While several states took steps towards fully. What is a personal property tax?

Taxpayers Who Pay Their Personal Property Taxes On Time Will Receive A Rebate On Their 2024 Income Tax Return — Even If The Second Half Was Paid In 2023.

Personal property guides and information.

Feb 12, 2024 / 09:40 Pm Cst.

— missouri residents could see a roughly $138 million tax break under legislation passed thursday by the house in an attempt to offset.

Since All Personal Property Taxes Are State Imposed, Each Jurisdiction May Include Different Types Of Property In The Tax Assessment.

Images References :

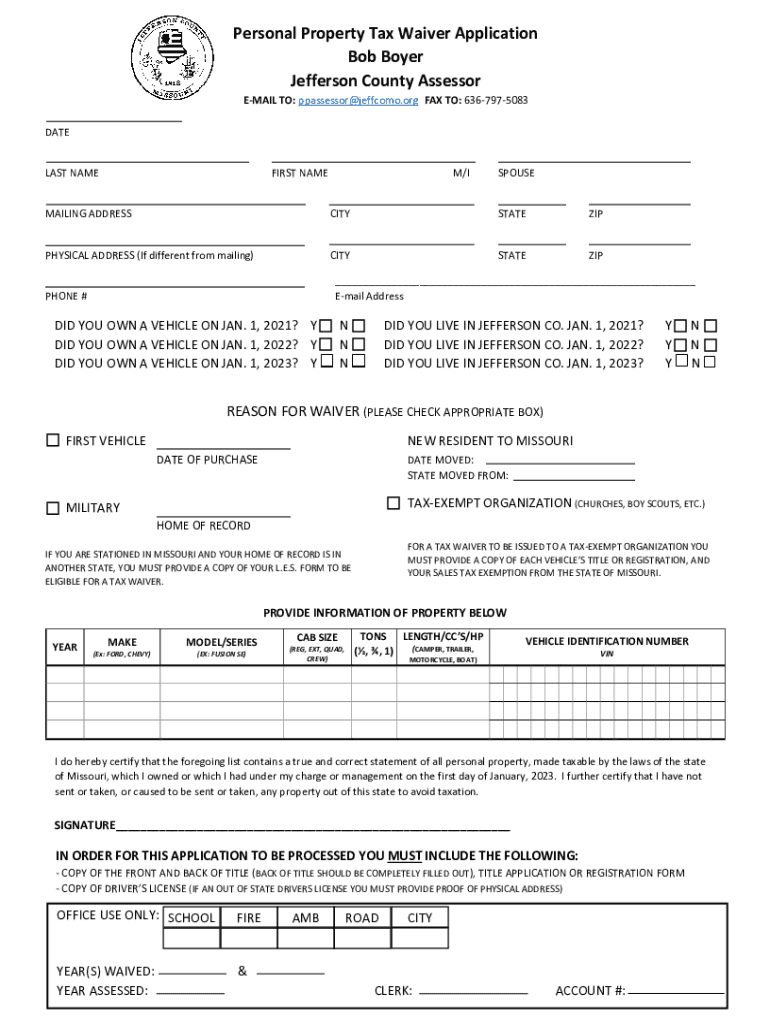

Source: www.signnow.com

Source: www.signnow.com

Jefferson County Personal Property Tax 20222024 Form Fill Out and, Feb 12, 2024 / 09:40 pm cst. In maryland there is a tax on business owned personal property which is imposed and collected by the local governments.

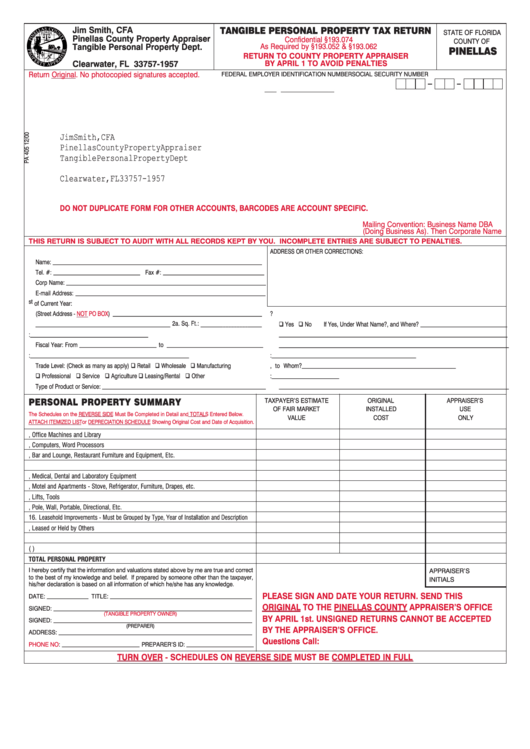

Source: www.formsbank.com

Source: www.formsbank.com

Tangible Personal Property Tax Return Form printable pdf download, In maryland there is a tax on business owned personal property which is imposed and collected by the local governments. It is an ad valorem.

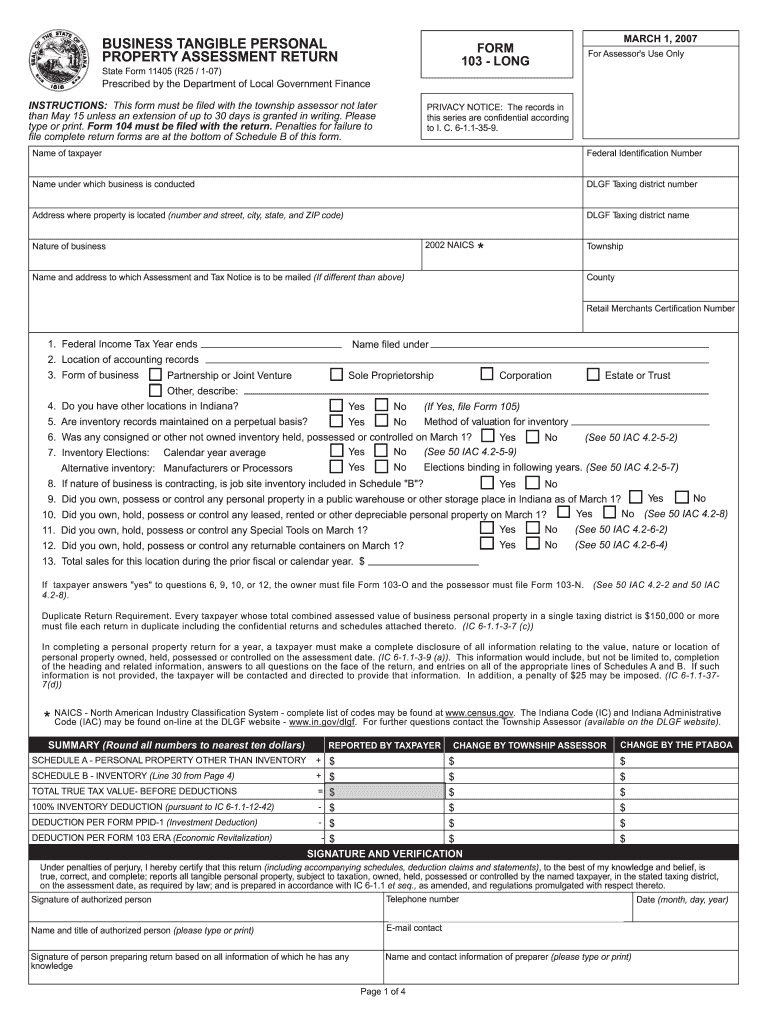

Source: my-unit-property-9.netlify.app

Source: my-unit-property-9.netlify.app

Real Estate Property Tax By State, Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal. This means taxpayers no longer need to file the.

Source: aruba.desertcart.com

Source: aruba.desertcart.com

Buy The new 20232024 Calender Planner 20232024 with Weekly & Monthly, Businesses in wisconsin are no longer subject to personal property tax as of january 1, 2024, due to the enactment of 2023 wisconsin act 12. Taxpayers who pay their personal property taxes on time will receive a rebate on their 2024 income tax return — even if the second half was paid in 2023.

Source: www.bonconseil.nl

Source: www.bonconseil.nl

Wetsvoorstel vermogensbelasting 2024, What is a personal property tax? Most state and local tax.

Source: www.pinterest.com

Source: www.pinterest.com

Auto Insurance NYS, Questions with accurate answers. Graded A. 2023/, If you pay taxes on your personal property and real estate that you own, you payments may be deductible from your federal income tax bill. Louis county assessor jake zimmerman says his office’s new online personal property.

Source: mungfali.com

Source: mungfali.com

2024 PNG, This means taxpayers no longer need to file the. Iras will send customised sms reminders with your property address, tax amount to be paid and.

Source: www.signnow.com

Source: www.signnow.com

Tennessee Tangible Personal Property Schedule 20202024 Form Fill Out, While several states took steps towards fully. Iras will send customised sms reminders with your property address, tax amount to be paid and.

Source: selaqangelique.pages.dev

Source: selaqangelique.pages.dev

How Much Will I Pay In Taxes 2024 Lola Sibbie, Thirteen states introduced bills aiming to fully eliminate taxes on tpp or provide a 100 percent exemption. What is a personal property tax?

Source: ratio-conference.net

Source: ratio-conference.net

RATIO Conference 2024, On january 1, 2024, wisconsin assembly bill (ab) 245 went into effect, exempting business personal property from taxation. Thirteen states introduced bills aiming to fully eliminate taxes on tpp or provide a 100 percent exemption.

It Is An Ad Valorem.

To help vehicle owners, the fairfax county board of supervisors approved 10% tax relief for personal property taxes as part of their fy 2024 adopted budget.

If You Pay Taxes On Your Personal Property And Real Estate That You Own, You Payments May Be Deductible From Your Federal Income Tax Bill.

Sdat.persprop@maryland.gov primary mailing address (for.